[ad_1]

Bitcoin (BTC) seems not to be relenting in its quest to scale the heights, given that its upward momentum is still life days after breaching the psychological price of $40K. The top cryptocurrency was up by 2.15% in the last 24 hours to hit $46,159 during intraday trading, according to CoinMarketCap.

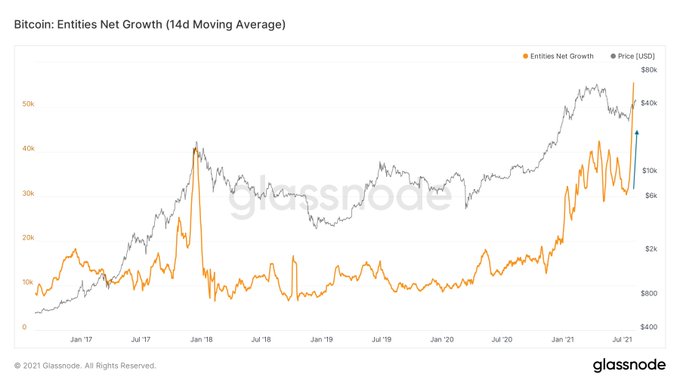

As 16.4% of the total BTC supply is back to profits, Crypto analytic firm Glassnode explained:

“Between the low of $29.7K, and the current price at $45.4K, a total of 16.4% of total Bitcoin supply returned to profit. This indicates that approximately 3.08M BTC were last spent, and thus have an on-chain costs basis in this price range.”

Furthermore, the latest surge has given short-term Bitcoin holders a reason to smile because their investments are back to positive values.

In May, BTC became the talk of the town after it nosedived from an all-time high (ATH) of $64.8K recorded in mid-April to lows of $30K. Nevertheless, the leading cryptocurrency is regaining lost grounds.

Bitcoin daily addresses eye the 1 million level

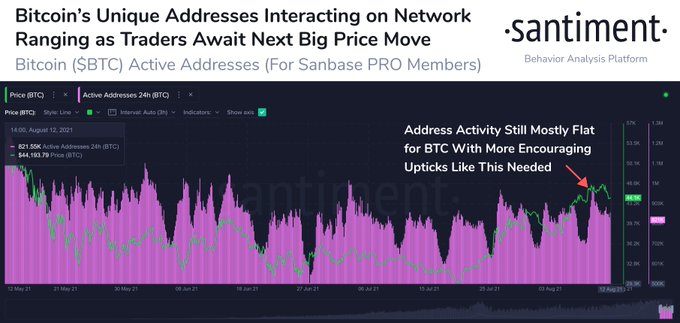

According to on-chain metrics provider Santiment:

“Address activity continues to be a very important metric to watch for hints on whether Bitcoin will cross $50K or fall below $40K. Currently 720K to 930K addresses use the BTC network daily, and we’re looking for a spike above 1m as a bull run signal.”

Therefore, a notable number of participants has been using the Bitcoin network., as acknowledged by on-chain analyst Lex Moskovski.

Significant on-chain resistance stands between $45.6K and $46.9K

IntoTheBlock believes that Bitcoin should shutter on-chain resistance between the $45.6K and $46.9K before getting the green light and heading towards the $50K level. The data analytic firm explained:

“As demonstrated by the high amount of trading activity, the biggest level of on-chain resistance for BTC in order to reach $50k is located between $45.6k and $46.9k, where 763k addresses bought 428k BTC.”

With an uptick in daily Bitcoin activity being recorded, whether this will trigger a surge to the psychological price of $50,000 remains to be seen.

Image source: Shutterstock

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment