[ad_1]

BTC has a market capitalization of near $1 trillion, whereas BSV is round $3 billion, or 0.3%. Many individuals ask why is BSV so low-cost in comparison with BTC? Such questions are on the coronary heart of the Environment friendly Market Speculation (EMH), a cornerstone of recent finance idea.

Eugene Fama received the Nobel Prize for his work on the Environment friendly Market Speculation, arguing that “a market by which costs at all times ‘totally replicate’ accessible info known as ‘environment friendly.’” However how do we all know if costs “‘totally replicate’ all accessible info”?

There are countless disputes about what the EMH truly means for asset costs, or certainly whether or not it’s simply an empty tautology (as Paul Samuelson, who received his Nobel Prize for different stuff, appeared to consider when he ‘found’ ‘environment friendly markets’ earlier than Fama).

Larry Summers calls it ‘Ketchup economics’: “Two quart bottles of ketchup invariably promote for twice as a lot as one quart bottles of ketchup.” However how a lot ought to one quart bottle of ketchup sell-for? Who is aware of!? ¯_(ツ)_/¯

As with ketchup, the EMH tells us little about what Bitcoin ought to truly be price, however the completely different Bitcoins might be in contrast. We are able to ask, does one Bitcoin equal one Bitcoin? If not, why not?

The desk beneath illustrates key metrics of the three protocols of Bitcoin: BTC, BCH and BSV. Hash fee and ‘community nodes’ are basically enter prices (though the true variety of ‘nodes’ in BTC is definitely solely round 30 block creators, versus the quantity ≈11,600 community observers used on this information); transactions and block sizes are the outputs. Taking into account that Bitcoin was designed as a transaction processing system, BTC may be very costly to run and produces little or no output. In distinction, BSV may be very low-cost to run and produces the vast majority of output.

With BSV round 0.3% of the worth of BTC, BSV’s largest drawback seems to be that it’s providing an inexpensive and environment friendly product when the market has been deceived into believing it needs a expensive and inefficient product. This isn’t sustainable in an environment friendly market.

So what’s happening?

Narrative as info warfare

Pricing tradeable capital belongings based mostly on an inherently unknowable future is the distinctive characteristic of a capitalist system, and why the principal exercise of capital market contributors is about amassing and processing info to higher perceive the longer term potential of belongings (to deduce the possible present worth). However in Bitcoin, there’s something moderately distinctive happening: warring narratives.

Every ‘tribe’ of Bitcoin has its personal narrative. Basically, BCH is about ‘privateness’ (cash laundering in technical language). BTC Core (BTC) is about artificially induced shortage and ostensibly ‘safety’ (nevertheless technically misplaced that notion is). Bitcoin Satoshi Imaginative and prescient (BSV) is about performance and productiveness (an enterprise blockchain for reasonable micropayments, good contracts and way more).

Because the Trendy Battle Institute at West Level navy academy notes, “Data warfare is, at base, a contest of narratives.” Data warfare is certainly what is going on within the broad ‘crypto’ group. How does the Environment friendly Market Speculation address info warfare? It doesn’t.

Misinformation is dangerous for capitalism

Environment friendly markets, therefore environment friendly capital allocation, therefore a functioning capitalism, in the end depend on the standard of data disseminated within the market. Dangerous info equals dangerous outcomes.

‘Crypto’ shares many options with historic bubble episodes, however it’s the first asset class to develop within the age of social media and ‘citizen journalism.’ There is no such thing as a value to creating misinformation and FUD. There may be truly a robust incentive to pay individuals to provide misinformation. That is very true when a brand new know-how emerges which is tough for outsiders to grasp, and one which is basically unregulated. Monopoly constructing on this house is the product of data warfare.

A part of the broader ‘crypto’ narrative is snug in recognising the doubtless pernicious function of misinformation within the realms of state propaganda. Edward Bernays argued in ‘Propaganda’ that authorities PR is solely an extension of company PR, and is an inevitable a part of sustaining ‘order’ in a democratic society.

Strategic narratives are an crucial on this system, and at the moment social media is the frontline within the geopolitical info warfare of competing narratives. It’s now considered a key danger to the prevailing ‘liberal order,’ and motive sufficient to deploy crack troops (reminiscent of Britain’s 77th Brigade) to plant authorized narratives, and de-legitimize different narratives (whether or not from inside actors or international governments).

As many individuals within the ‘crypto group’ are conscious, the social media firms have been seconded into this course of, and whereas possible concerning all this as clearly true, BTC folks appear very reluctant to just accept that whereas a part of their very own narrative is poking enjoyable at individuals for being pawns to energy, they themselves are helpful idiots for company propaganda selling a self-serving monopoly: Bernays’ ‘invisible rulers.’

CEOs of firms concerned within the house are free to make what is perhaps considered both mind-boggling facile, and even ‘false and deceptive,’ statements on social media, with none type of comeback from regulators. How can an trustworthy narrative be claimed when the alleged advantages of ‘financial vitality,’ even when it’s a utterly idiotic meme, are promoted by a high-profile CEO?

And even that Bitcoin will unite the world?

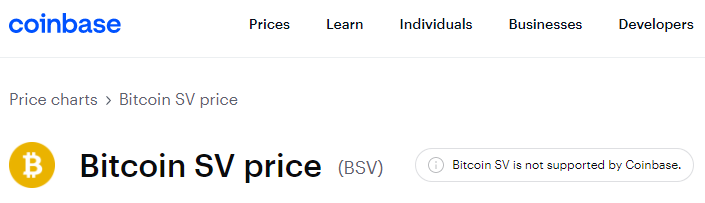

Whereas these ridiculous memes are implied to come back from some greater aircraft of understanding, it’s clearly nothing greater than model promotion for his or her explicit tribe, BTC. It’s no secret that BSV has been actively suppressed, with many exchanges performing as a cartel to delist BSV as a barrier to adoption. Though critical buyers won’t perceive this as a result of the knowledge is suppressed:

Why are they doing this? Adam Smith warned 250 years in the past that “Folks of the identical commerce seldom meet collectively … however the dialog ends in a conspiracy towards the general public, or in some contrivance to lift costs.” The ostensible argument is that they don’t like Craig Wright, and (at the very least publicly) they declare that he’s not the creator of Bitcoin. This is perhaps ‘logical’ from a hive of self-serving cyber-hornets or sock-puppets on social media, however we’re coping with supposed adults on the head of main companies.

Arguably, they wish to pump a pointless ‘scarce digital asset’ (which is definitely simply replicable) to assist their very own monetary pursuits. Extra basically they don’t like competitors from a know-how which kills their profitable legacy enterprise fashions. Doubtful feel-good PR will get promoted as ‘info’ and FUD towards a less expensive, superior know-how is promoted as a result of it defuses the menace to present monopolies. The narratives are promoted by credulous and sometimes conflicted ‘journalists’ within the company media.

Speaking provide to pump demand

Alongside the ‘financial vitality’ and world peace nonsense, one of many biggest PR workouts in BTC is the stock-to-flow (S2F) ratio. Seemingly any worth might be justified as a result of, er, ‘science.’ The so-called S2F mannequin obscures the truth that demand is definitely necessary in a demand-supply evaluation (what’s referred to as Alfred Marshall’s Scissors: every blade is necessary).

Once more, the good thing about the EMH is that its worth will not be in absolute worth predictions, however in evaluating comparable belongings. The S2F mannequin is looking for to match BTC to gold and silver however ignores the truth that the stock-to-flow ratio is basically precisely the identical for all Bitcoins: BTC, BCH, and BSV. In actuality, the S2F mannequin is implicitly arguing (but ignoring) that whereas the S2F ratio is perhaps helpful in choosing potential scarce financial belongings, demand is definitely the important thing (unknowable) variable in figuring out costs.

By extrapolating a historic development into the longer term, the S2F mannequin can be implicitly stating that—in contrast to another market in historical past apparently—demand for BTC is invariant to cost. Why wouldn’t all of the monetary wealth in the entire world be ‘invested’ in a pointless digital asset? If the S2F mannequin is alleged to make BTC look low-cost, it makes BSV appear like the chance of the century! However you received’t hear that within the ‘science.’

The principal explanatory issue is clearly demand, not provide, however the level of the S2F mannequin is to create social-media buzz to advertise BTC. It might assist pump the short-term ‘demand,’ however sustained demand is in the end a product of utility, not merely the discovering of extra greater-fools.

Regulation will finally kill false narratives

When Satoshi launched the Bitcoin protocol in February 2009, he said that, “It takes benefit of the character of data being simple to unfold however exhausting to stifle.” But whereas it’s tough to positively stifle info, social media has made it very a lot simpler to negatively stifle info, by burying helpful and true info in an extra of irrelevant info and outright disinformation.

Such info warfare has destroyed the market’s means to sensibly worth belongings on this house. This isn’t simply one of many largest bubbles in historical past, it’s a bubble which has consciously seconded the knowledge warfare potential of unregulated world markets and social media to maintain it. Misinformation on this house is reasonable to provide, profitable, and straightforward to keep away from accountability. Sadly, it’s also extraordinarily damaging to the underlying financial system.

It’s clear that the ‘crypto’ narrative has been developed exactly to undermine the notion of environment friendly markets, that costs replicate all accessible info. The cyber-hornets, supported by monopoly lease seekers and lazy and conflicted churnalism, proceed to provide a vastly manipulative misinformation narrative to pump a bubble.

Capitalism is, largely, an info processing system, and a part of the explanation for regulation in monetary markets is exactly as a result of false or deceptive info is extraordinarily damaging to capital allocation and the general financial course of. This is the reason market manipulation, by means of misinformation or in any other case, is illegitimate. The Poor Market Speculation is that info warfare in the end kills a functioning capital allocation system, undermining the important info processing and incentive system we name capitalism.

The narrative has served BTC promoters properly so far, but lately the media focus has been on BTC shedding the knowledge conflict to Ethereum. However because the slim confines of social media bubbles develop to incorporate regulated views, extra discerning buyers and cost-effective real-world enterprise instances, true and helpful info will finally inform the story. Really environment friendly markets will possible ring the demise knell of the ‘crypto’ bubble, however don’t count on BSV to be price lower than 0.5% of BTC ceaselessly.

New to Bitcoin? Try CoinGeek’s Bitcoin for Novices part, the last word useful resource information to be taught extra about Bitcoin—as initially envisioned by Satoshi Nakamoto—and blockchain.

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment