[ad_1]

Good morning. Here’s what’s happening this morning:

Market moves: Bitcoin edged toward $58,000 as altcoins and other layer 1 tokens recovered from seven-day lows.

Technician’s take: Momentum is improving as oversold readings appear on the chart.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $57,550 +1.82%

Ether (ETH): $4,346 +5.93%

Market moves

Bitcoin struggled to move above $58,000 during U.S. trading hours on Tuesday, while alternative cryptocurrencies (altcoins), including ether and other layer 1 tokens recovered to above their seven-day lows.

As a result, the bitcoin dominance chart, which shows the extent of the crypto’s dominance over the rest of the market, continued to signal a bias toward altcoin exposure, according to TradingView, down to roughly 42.31% from October’s high at 47.41%.

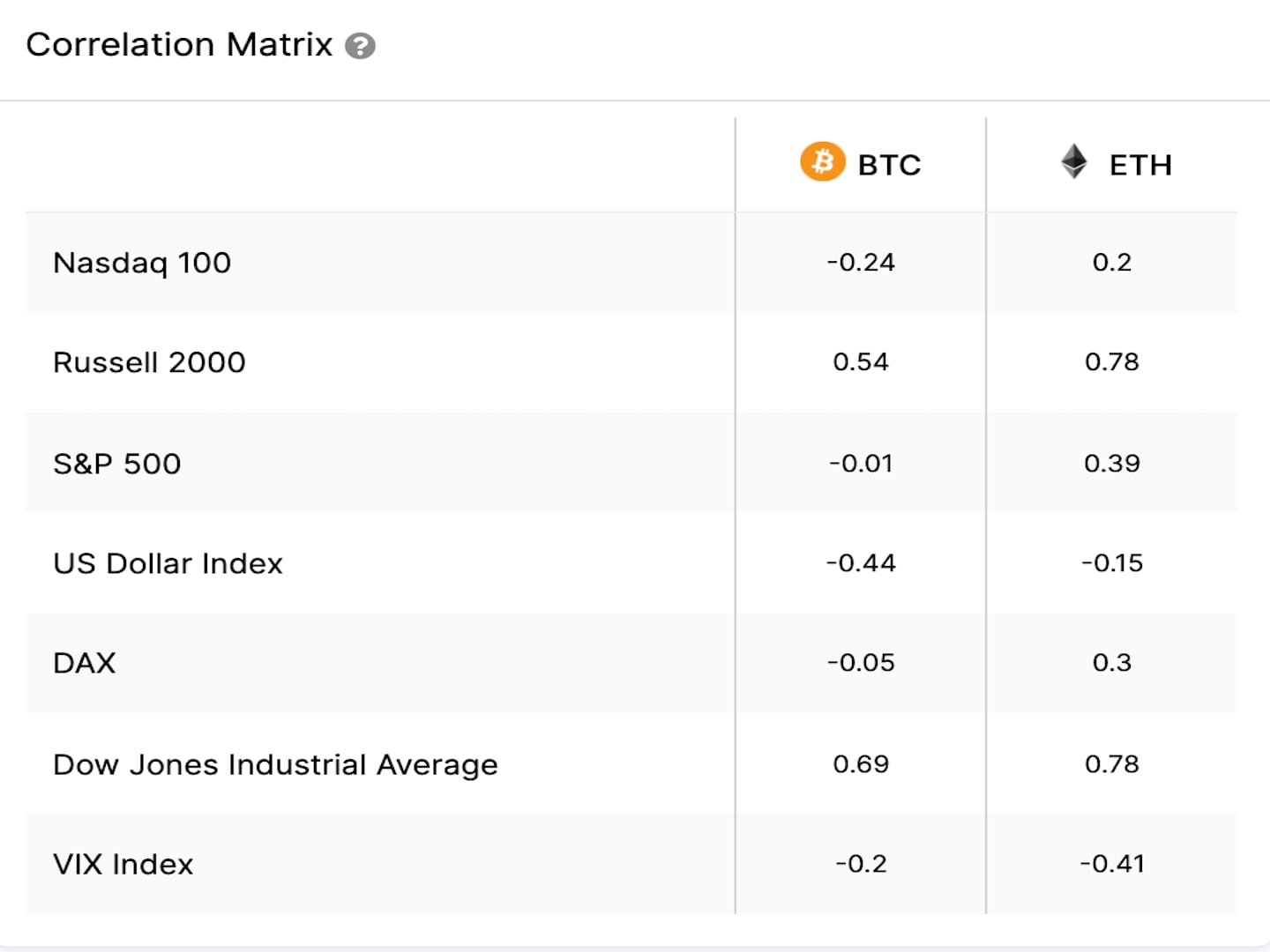

Lucas Outumuro, head of research at blockchain analytics firm IntoTheBlock, noted a stronger correlation between the stock market and ether than between stocks and bitcoin.

“Bitcoin is struggling to consolidate as an inflation hedge but is also not following risk assets, which may be leaving some investors uncertain,” Outumuro said. “Ether has been more closely correlated to stocks, which suggests investors [are] treating it more like a risk-on trade.”

On the traditional markets, technology stocks moved the S&P 500 lowered on Tuesday, which could have a negative impact on the crypto market on Wednesday.

Technician’s take

Bitcoin Holds Support at $56K, Resistance at $60K-$63K

Bitcoin (BTC) appears to be oversold, which could support a brief rise toward the $60,000-$63,000 resistance zone.

The cryptocurrency has held short-term support at about $56,000 as selling pressure has stabilized.

The relative strength index (RSI) is rising from oversold levels, similar to what happened on Oct. 27, which preceded a price recovery. On the daily chart, the RSI is approaching oversold levels for the first time since late-September.

Further, bitcoin’s correction from an all-time high of nearly $69,000 appears to be exhausted, which could encourage buyers to return. Momentum is improving into the Asian trading day, although resistance at around $63,000 could limit further upside over the short term.

Important events

8:30 a.m. (HKT/SGT (8:30 a.m.): Japan Manufacturing PMI (purchasing managers index)

8:40 a.m. HKT/SGT (12:40 a.m.): Speech by Michele Bullock, the Assistant Governor (Financial System) at the Reserve Bank of Australia

CoinDesk TV

In case you missed it, here are the most recent episodes of “First Mover” on CoinDesk TV:

What Jerome Powell’s Second Term as Fed Chair Means for Crypto, Crypto Exchanges’ Sports Sponsorships Binge

“First Mover” hosts spoke with Crypto.com CEO Kris Marszalek as crypto exchanges go on a sports sponsorship binge. Katie Stockton, Fairlead Strategies technical analyst, shared her insights on market movements. Plus, Lukas Enzersdorfer-Konrad, Bitpanda chief product officer, explained the new partnerships with French mobile financial services super-app Lydia to facilitate access to digital asset investing for everyone.

Latest headline

Binance Rebuilding DOGE Wallet to Deal With User Account Freeze

French Fintech Lydia Taps Bitpanda to Let 5.5M Users Trade Crypto

Bank of England Governor Touts CBDCs Over Stablecoins: Report

Brazil’s Central Bank Plans to Launch a CBDC Pilot in 2022: Report

Junk-Rated El Salvador’s ‘Bitcoin Bonds’ Look Explosive (Think Volcano)

Longer reads

Ethereum’s Fees Are Too Damn High

Why Barbados’ Metaverse Embassy Matters

Today’s Crypto Explainer: How to Send Bitcoin Tips on Twitter

[ad_2]

Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano

Be the first to comment