Bitcoin (BTC) was up by 4.47% in the last seven days to hit $47.978 during intraday trading, according to CoinMarketCap.

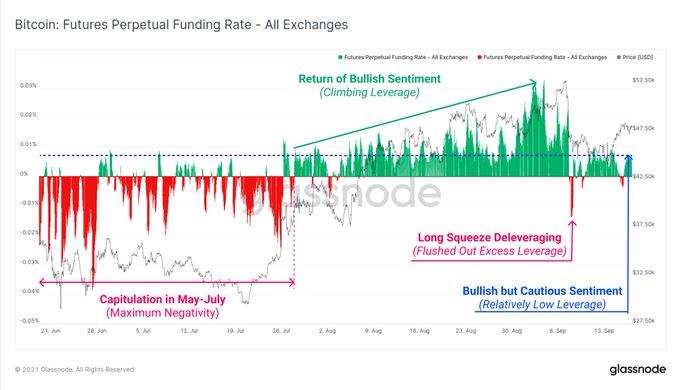

This surge in price has been instrumental in flipping BTC futures perpetual funding rate positive. Yann & Jan, the co-founders of crypto analytic firm Glassnode, explained:

“Traders in Bitcoin futures markets remain reasonably bullish with a positive funding rate returning to perpetual swap contracts. Note how funding rates are positive, but not up to the same level as before the $10K sell-off last week. The Bitcoin market is bullish, but cautious.”

Bitcoin funding rate turned negative as the leading cryptocurrency recently recorded a 10% daily loss as over-leverage factors dominated. Precisely, BTC experienced a significant pullback that prompted a $10K loss, given that Bitcoin longs were over-leveraged.

Bitcoin exit exchanges in droves

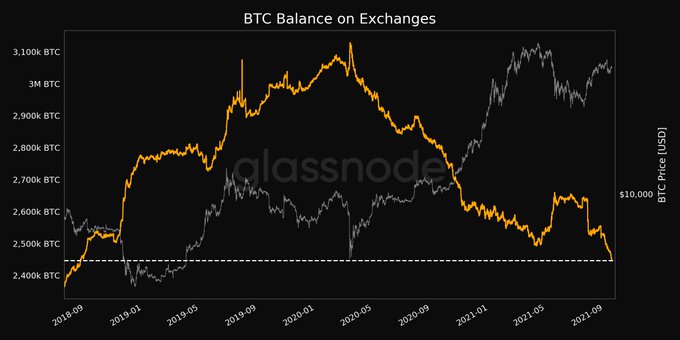

According to Glassnode, Bitcoin balance on crypto exchanges sank to a 3-year low of 2,446,784.107 BTC.

This usually signifies a holding culture because coins are transferred from exchanges to cold storage and digital wallets, which is bullish.

Meanwhile, BTC whales are on a buying spree, as acknowledged by Will Clemente. The on-chain analyst noted:

“Whales bought another 31,848 BTC today, equivalent to $1.5 billion & Exchange balances have now gone down 10 consecutive days.”

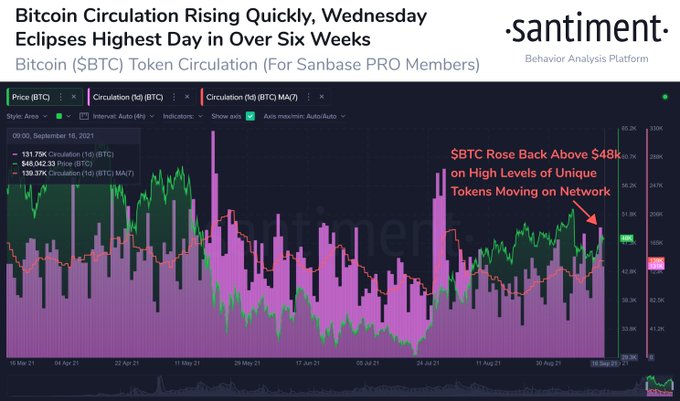

On the other hand, the amount of unique tokens moving on the Bitcoin network, known as token circulation, is uptrending. This is because 187.9 unique coins recently moved, a fate not seen since July 29.

Therefore, BTC has witnessed an uptick in activities, which recently helped the top cryptocurrency surge above the 200-day moving average (MA). Moreover, a golden cross was confirmed, which occurs when a short-term moving average crosses over a major long-term moving average to the upside and is usually interpreted by analysts as an upward turn in a market.

Image source: Shutterstock

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Solana

Solana  USDC

USDC  XRP

XRP  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin  Toncoin

Toncoin

Be the first to comment